What is Tax Equity?

Many renewable energy technologies including solar qualify for two federal incentives that are available to the owner of a renewable energy asset, the 30%Business Energy Investment Tax Credit (ITC) and MACRS accelerated depreciation benefit. The value of these benefits are based upon the qualified cost of the project. In order to take advantage of these benefits a solar project must be placed in service by December 31, 2016. Solar Capital Finance works with individuals and institutional investors that invest in renewable energy projects to receive the valuable tax benefits.

MACRS Depreciation

MACRS allows for real property to be depreciated on an accelerated basis according to a schedule that is provided by the IRS. Solar along with wind and geothermal projects are specified as five year property and depreciated at a set rate on a six year schedule. Other technology such as biomass and hydro depreciate on longer schedules. For qualified projects placed in service before December 31, 2013 the IRS allows for a project owner to take 50% bonus depreciation in year 1. Please contact SCF for a complete depreciation analysis on your project.

Tax Equity Project Structures

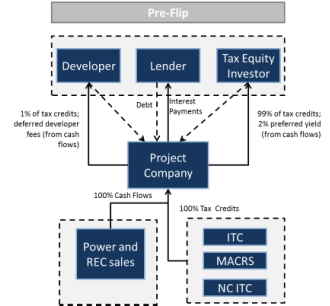

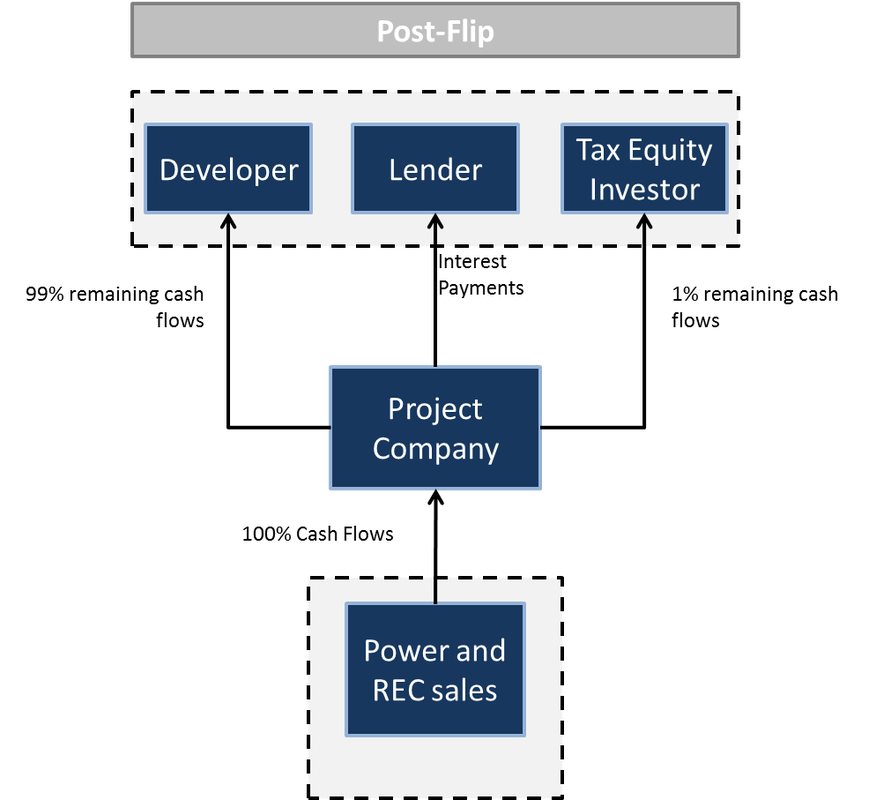

A market for tax equity exists because most developers do not have the internal tax appetite to take these benefits within their company. This prompts project developers to look to outside financing sources that have a need for the tax shelter. To take advantage of the tax benefits certain ownership criteria must be met by the incentive holder so that the full incentive benefits can be realized. To accomplish this SCF uses a partnership flip method in which the tax equity investor owns a majority of the project for 6 years and when the benefits are realized the ownership reverts back to the developer. The benefit of the flip is that

Partnership Flip- A tax equity partnership flip allows for a tax investor to take advantage of the benefits without a long term commitment to the project for the term of the lease or power purchase agreement. Below is a diagram showing how the partnership flip method generally works. For Investors

Tax Equity is an excellent investment for individuals and corporations that have a tax liability and would prefer to invest capital in an income producing asset as opposed paying the IRS. Solar Capital Finance typically structures investments so that investors typically receive a 1.4 to 1.6 multiple on their investment over the 6 year flip model. In addition, by taking the ITC and bonus depreciation benefit in year 1 the investor has a majority of their investment paid back in less than a year. An investor also has an opportunity to earn a preferred return on cash flow generated from operations.

|

|